April 2025 Update

Making The News

Liberation Day

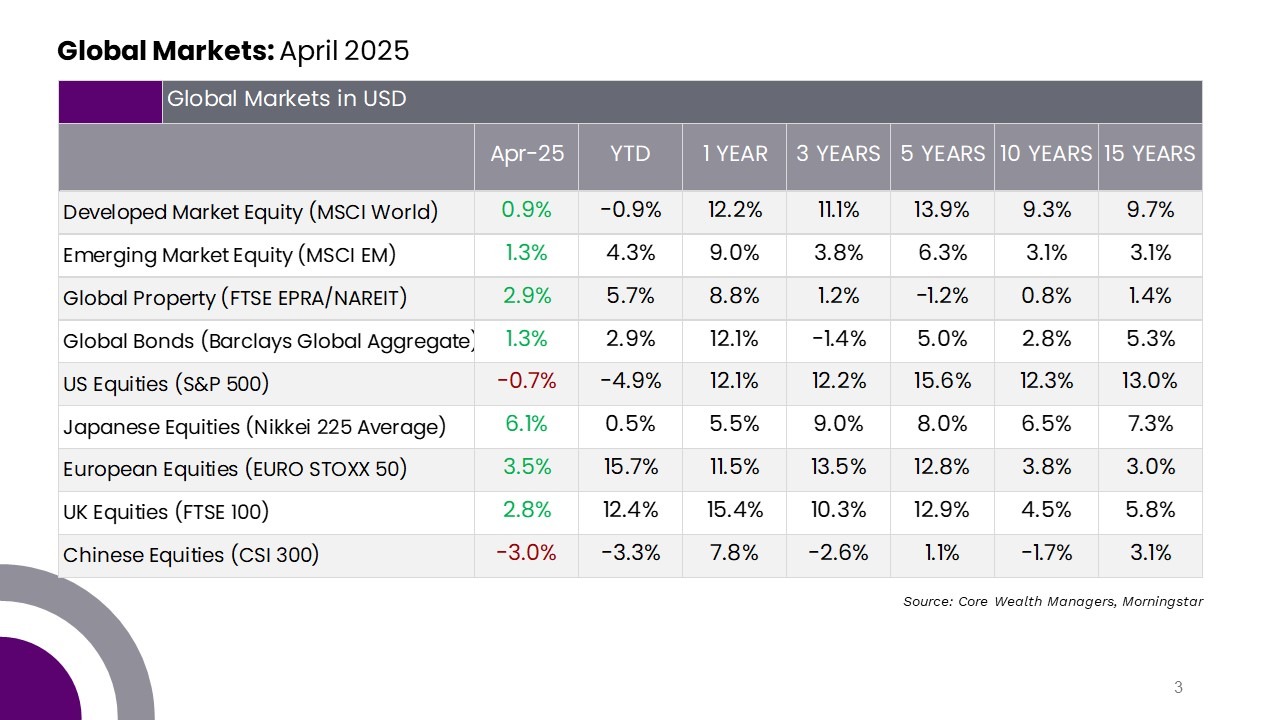

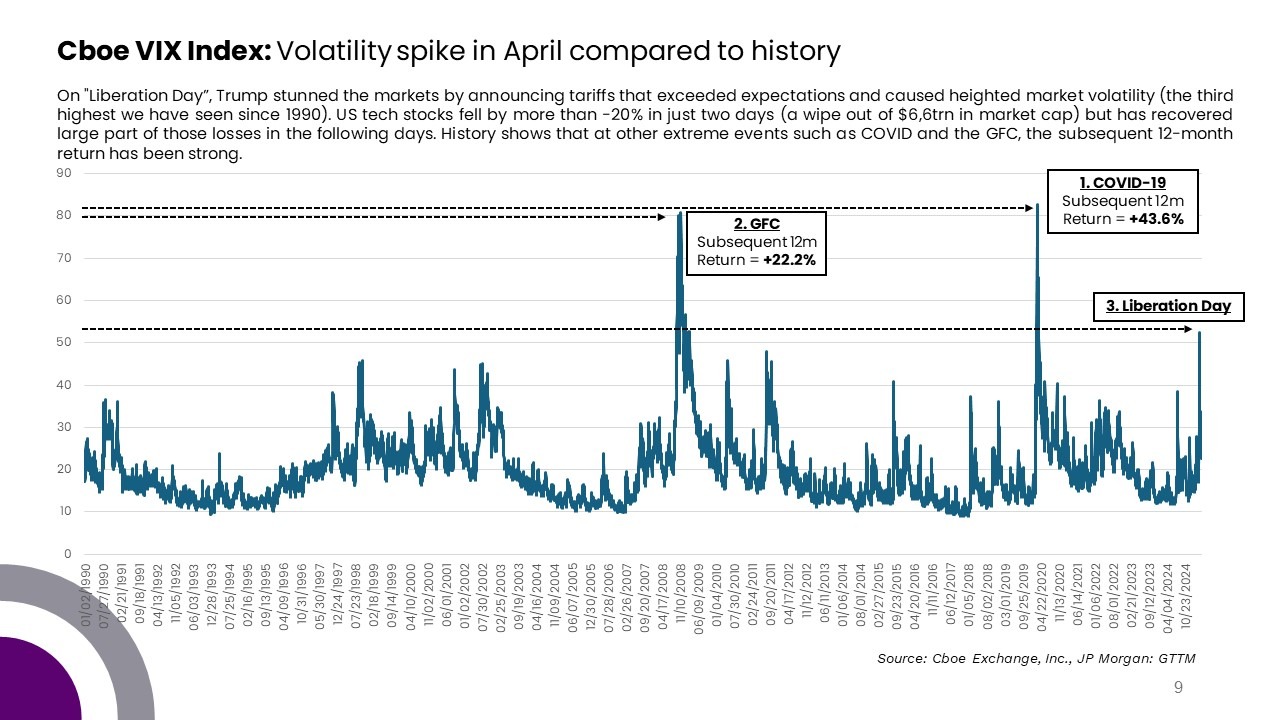

On 2 April, President Trump imposed a 10% baseline tariff on all imports, with some countries facing higher rates. Markets dropped sharply but recovered after a 90-day pause was announced. Meanwhile, US earnings were strong—S&P 500 profits rose 15% year-on-year, beating expectations by 9%. However, tariff uncertainty led many companies to hold or withdraw guidance.

Emerging markets held up well, but China bore the brunt of the tariffs

Emerging markets also gained (MSCI EM +1.3%), helped by a weaker US dollar, which had its worst month since 2022 (-4.6%). While Chinese stocks lagged due to tariff concerns, gains in India, Mexico, South Korea, and Taiwan more than made up for it.

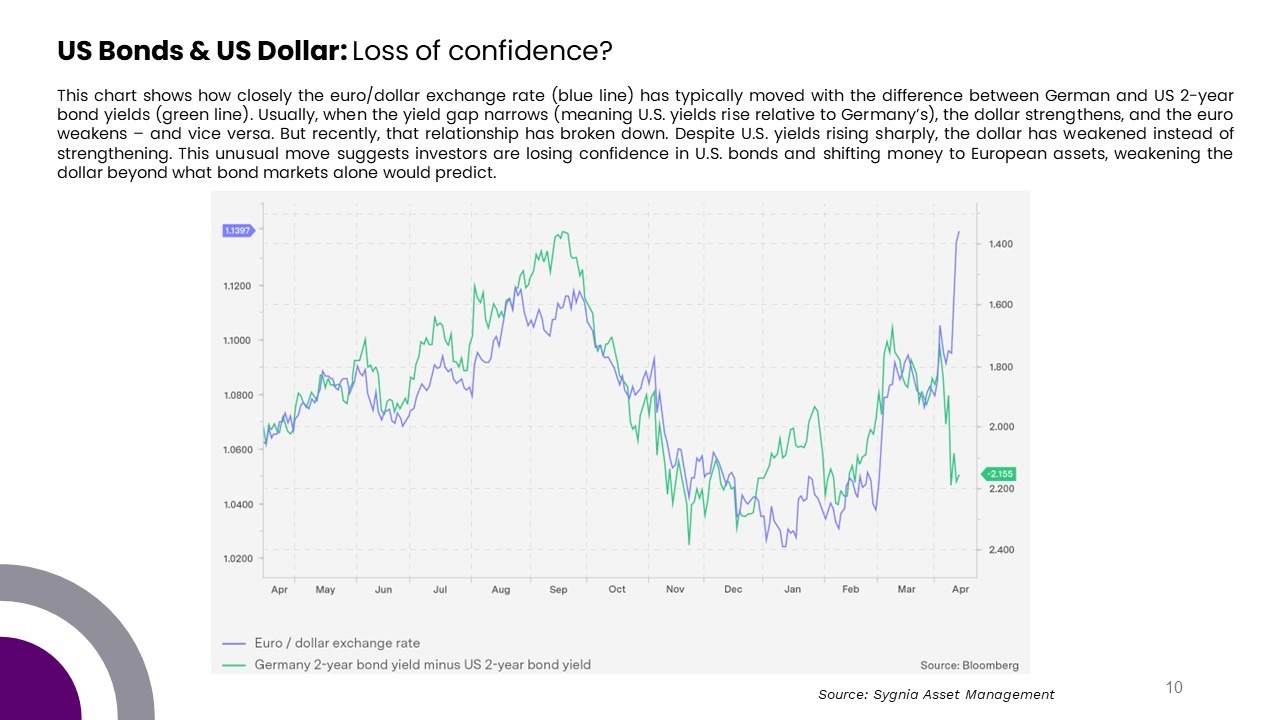

US bond markets were volatile

The US 10-year yield dropped below 4% on recession fears, then rebounded toward 4.5% amid foreign bond selling and political noise around Fed independence. Yields settled near 4.2% by month-end.

OPEC+ producers set to increase supply

Oil prices slumped 15% (Brent), hit by a surprise OPEC+ supply boost and growing demand concerns.

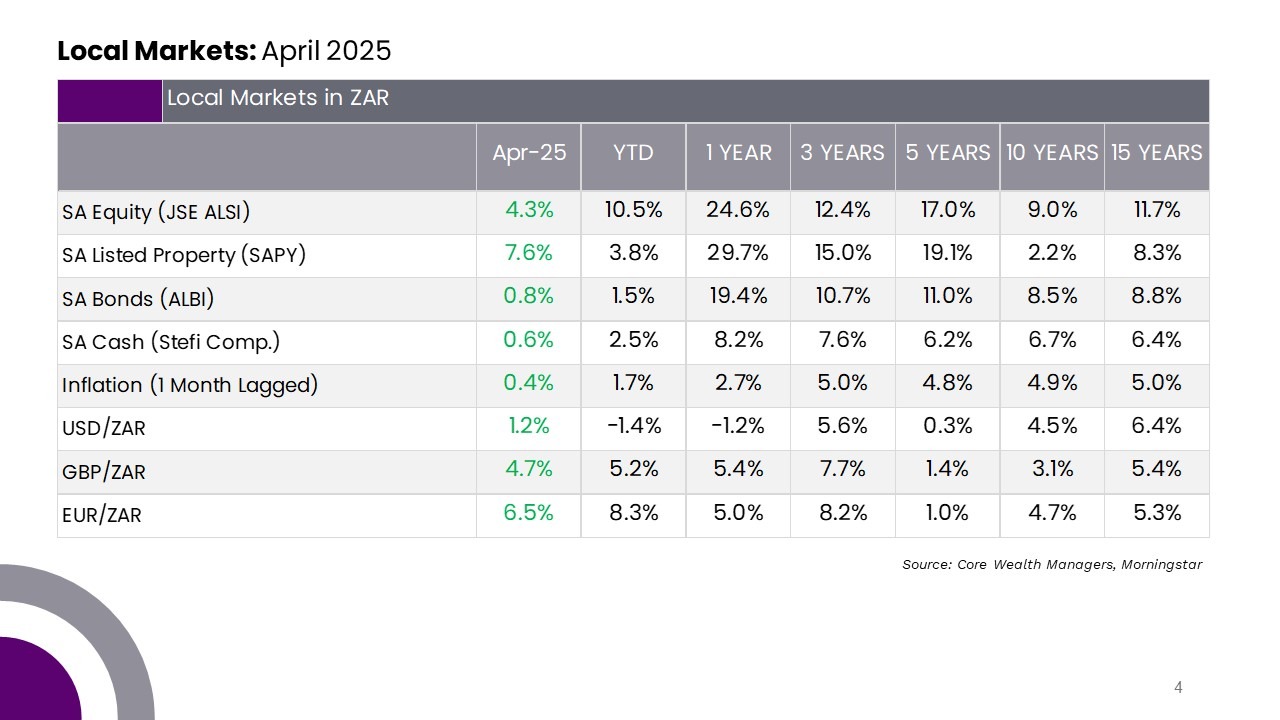

Local shares ended the month up strongly

South African equities saw a volatile April, with the ALSI rising +4.3% despite an initial plunge of ~14% following the US announcement of sweeping

trade tariffs. The local market rebounded sharply after the US paused implementation for 90 days, allowing for negotiations. President

Ramaphosa’s appointment of Mcebisi Jonas as special envoy to the US and the backtrack on the proposed VAT hike by Finance Minister

Godongwana helped ease both external and internal tensions, supporting the market recovery.